Special thanks to all who have subscribed! I hope everyone enjoyed their Holiday and is having a prosperous 2024.

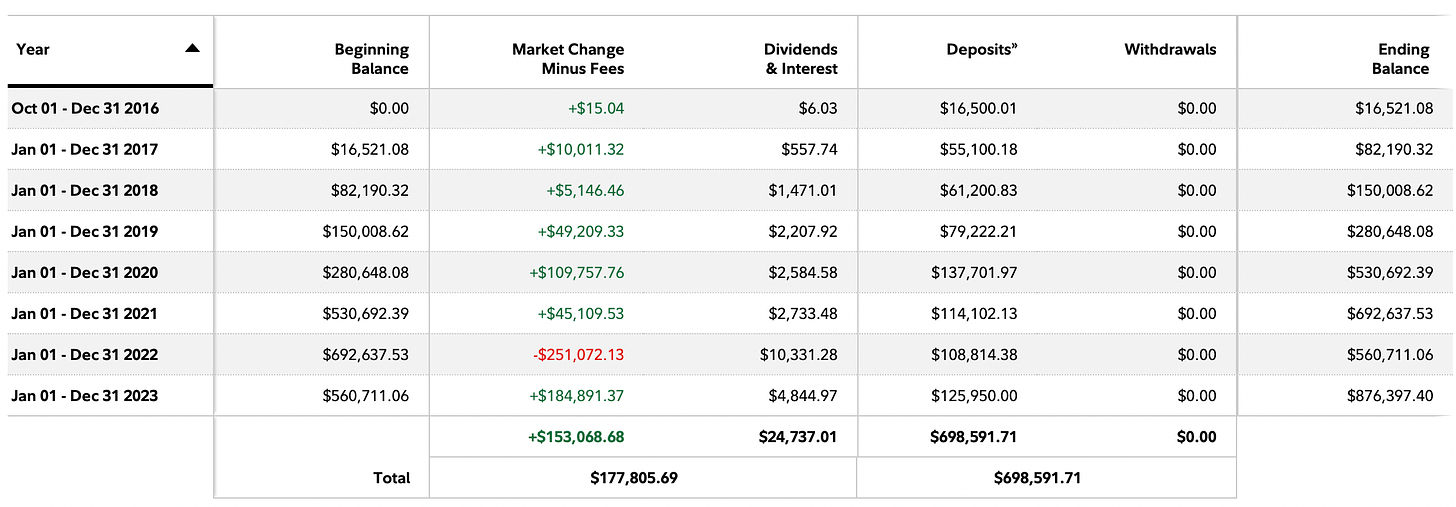

Sabre Arc Capital ended the year at $876,397, another record closing, and only $123,603 away from hitting $1 million. As you can see below, the fund started in 2016 with $16,500 in deposits. I look at the table below from time to time to see how far we have come. 2023 was surprisingly refreshing after the beating we took in 2022.

We started 2022 with $560,711.06, which seemed like a few years until we hit $1 million. However, after ending the year at $876,397, I am convinced we can hit the elusive $1 million target in 2024.

Keep reading with a 7-day free trial

Subscribe to Becoming Berkshire to keep reading this post and get 7 days of free access to the full post archives.