Sabre Arc ended the month of October with $774,404, an all-time end-of-the-month high! The fund received $241.59 in dividends, and three positions continued to make up nearly 50% of the portfolio. We had $40,000 in cash and $10,000 in fixed coupon certificates of deposits (“CDs”). A 12-year-old me would have given a different answer if you asked me what CDs were, but I digress.

What We Purchased

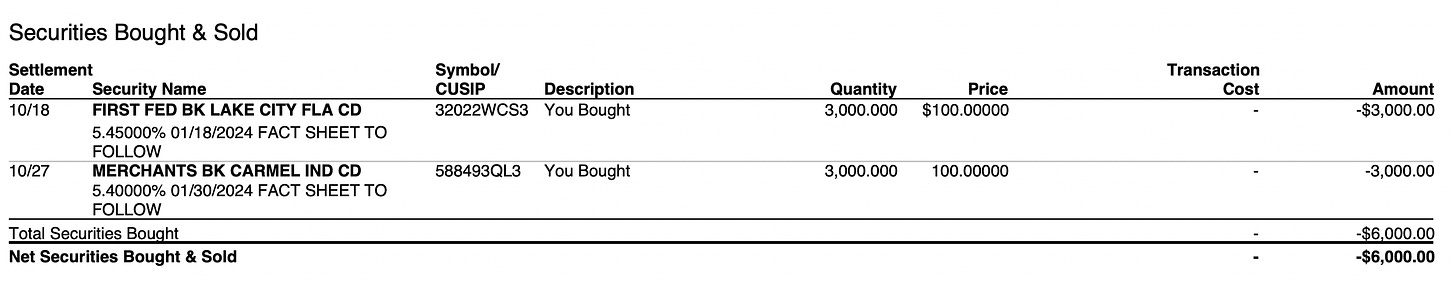

Our firm purchased two three-month CDs at 5.4500% & 5.4000% respectively. We did not make any additional investments.

Dividends & Interest

We received $175.34 in interest & $66.25 in dividends from Nike. Sabre Arc has now received $3,590.50 in dividends & interest for the year. One fascinating aspect of this number is that a term of the partnership agreement states that each partner must deposit a minimum of $300 each month, totaling $3,600 annually. For each partner we add, we should expect a minimum of $3,600 in deposits; however, we have received nearly $3,600 this year without adding another partner. This can be seen as our first employee, or better yet, our first resident of Sabre Arc-ville. This fictional resident gladly partakes in a life of toil, 24/7, 365 days a year, for the benefit of Sabre Arc. We are working hard at finding this resident a partner ($7,200 in dividends & interest) so they may happily compound and produce children. We shall keep you posted.

Keep reading with a 7-day free trial

Subscribe to Becoming Berkshire to keep reading this post and get 7 days of free access to the full post archives.