Thank you to all the new subscribers❤️, both paid and free.

Portfolio

Sabre Arc ended the month with $1,132,767.37, down $4,242.50 from the prior month. October was a quiet month compared to the enthusiasm we are seeing today in the markets. The Trump trade is alive and well, and it's understandable that investors are excited to see less regulation and a more business-friendly administration. Still, Mr. Market, being the manic depressive that he is, always tends to make me hesitant when everything goes up.

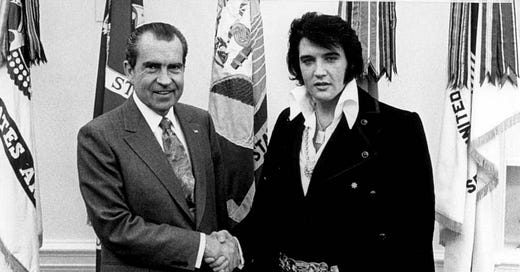

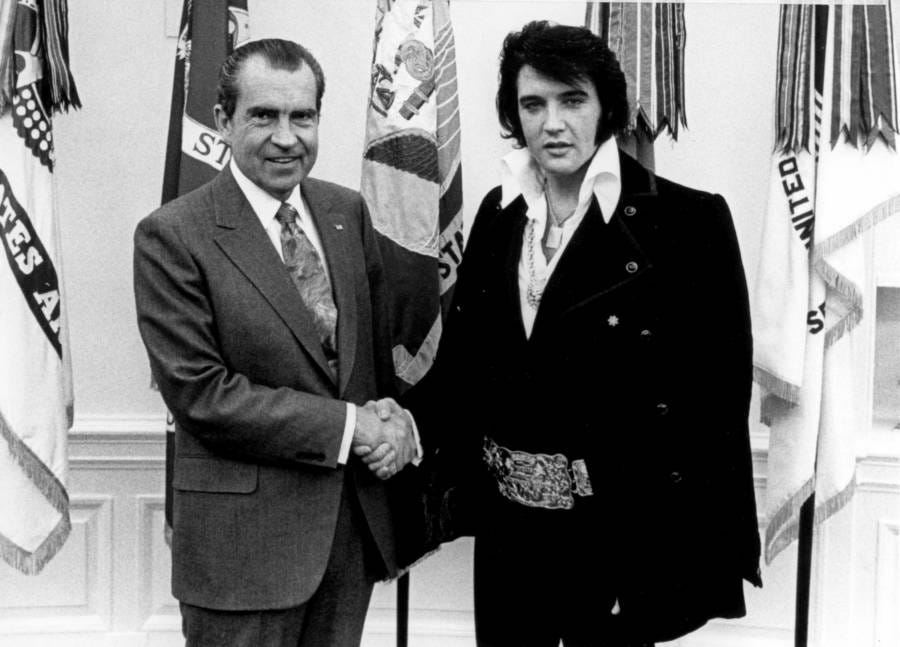

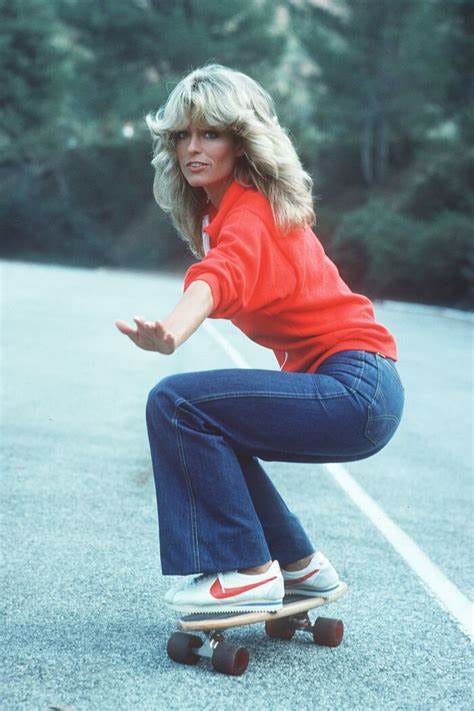

I started Becoming Berkshire in hopes of becoming a better investor and businessman. I’ve thus far studied investor sentiment rising to a level of absurdity during the 1960s, and I currently find myself in 1970, where music has stopped, and Wall Street has gone from crisis to crisis.

I am trying to discover how one knows that the pendulum has swung too far and that Mr. Market is no longer rational in assessing future growth. For example, how does one justify Tesla at a trillion by using traditional DCF models, but at the same time, how does one not get excited at Tesla's prospect and the possibility that the ease of regulation will welcome the next stage of innovation for the company? Researching the markets' history alongside Berkshire Hathaway's growth has helped put this market in perspective.

This is our third presidential election, as we started Sabre arc a few weeks before the 2016 election. The difference is that back in 2016, we had around $5k invested, compared to over $ 1 million. We never paid much attention to allocation based on which party is in the White House; however, having the possibility of republican control for the next two years has us thinking about the landscape in which our businesses participate. It’s a fun thought experiment, but I don’t think it would play a material factor in which company we buy or sell.

Activity & Holdings

Keep reading with a 7-day free trial

Subscribe to Becoming Berkshire to keep reading this post and get 7 days of free access to the full post archives.