First off, I want to take a moment to thank all of you—both paid and free subscribers—for your continued support of this publication. I skipped a couple of months recently, largely because there wasn’t much activity in the fund… but boy, has that changed.

I’ve written before that you don’t really know what kind of investor you are until a crisis tests your conviction. It’s easy to feel confident when everything is going up. It’s a lot harder when things get messy. Groundbreaking wisdom, huh?

By all intents and purposes, I’m a concentrated investor. A handful of securities make up 70–80% of our portfolio. That means any big move—up or down—in a single name can significantly impact our performance for the entire year. Thank you, Disney & Nike,

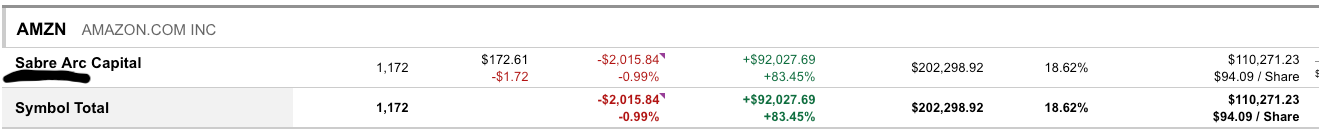

But I’ve also learned that the longer you’re in the market, the less phased you become by short-term gyrations. For example, Amazon is down 21.62% year-to-date, but the position is still up 83% overall. That kind of perspective only comes with time.

Standard deviation measures short-term volatility in stock returns, but its impact tends to diminish over longer holding periods. Market fluctuations tend to smooth out. While I don’t put much weight into measuring standard deviation per se, the principle behind it is sound: the longer you hold a security, the less painful volatility becomes.

This is evident by my personal holding as well, which i’ve held since 2015.

Not trying to flex, ok, maybe a little, but I wanted to show the importance of not selling.

Sabre Arc Capital

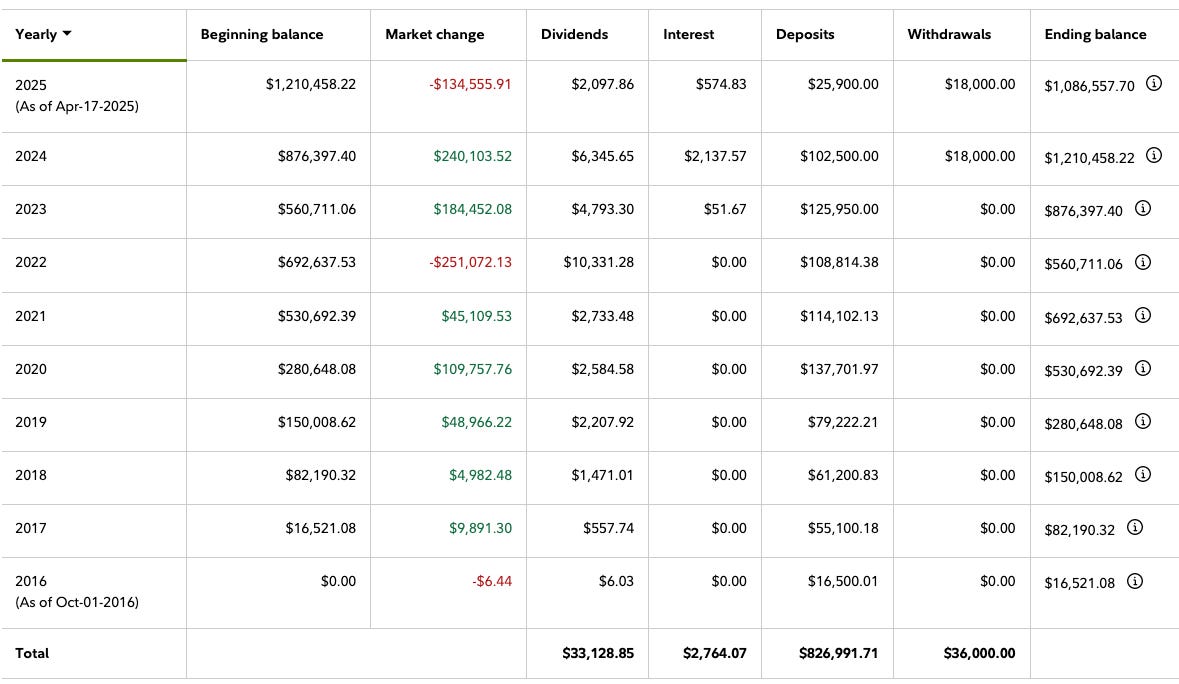

We ended the month of March down $94,000, which, thankfully, didn’t phase anyone in the group. For those who are new, Sabre Arc is a 17-member partnership. While ownership stakes aren’t identical across the board, I do my best to take everyone’s perspective into account when managing the portfolio.

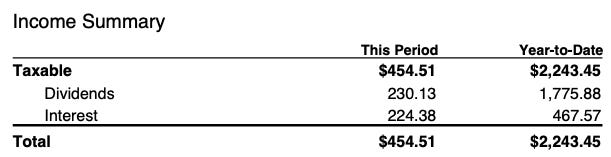

Thankfully one number that stays rather consistent is the dividends and interest that gets paid out. The goal for the year remains 10K!

War Chest

I believe we started February with around $50,000 in cash, and as stocks began to fall—particularly the large-cap tech names we own—we started to deploy capital. We hold 20 positions, and when they all begin to sell off, I do my best to spread our funds around. Normally, we focus on one or two names we believe are undervalued. The challenge with that strategy, though, is that we eventually run out of money.

We rarely sell, so when stocks keep dropping week after week, it’s a terrible feeling to watch your positions crater with no dry powder left to “buy the dip;” (sometimes I really hate that saying)

At the same time, this might actually be a good thing. We’ve spent the last eight years building this portfolio, and sometimes, the best move is to sit on your hands and let the market do its thing, even if this “thing” is killing you softly. Adding $10,000 to $20,000 doesn’t move the needle the way it used to.

If I’m anything, I’m a student of financial history. While I haven’t lived through a truly prolonged downturn, I’m doing my best to mentally prepare for the reality that markets don’t always bounce back as quickly as they have in recent years. We can’t afford to be naïve.

We hold a relatively small position in Nvidia—just 1.2% of the total fund—but when the stock drops 10 points, I feel the pressure to add, if only to avoid disappointing the other partners. It’s a balancing act: trying to manage the portfolio while also managing expectations. Ironically, when there’s nothing left in the war chest, I sometimes feel a strange sense of calm.

The Dow first hit 1,000 intraday in 1966, but it didn’t close above that level until November 14, 1972. Even then, it didn’t stay consistently above 1,000 until 1982. That’s 16 years of stagnation. Lately, I worry we’ve come to expect too much from the companies we follow.

As always, I leave you with our YTD and total returns.

May the market be with you…

Becoming Berkshire 1930-1972:

Issue 22| 1972 Part 2 -The Nifty Fifty

Issue 21| 1972 - See's Candies

Issue 20| 1971 Part 3- The Nixon Shock

Issue 19| 1971 Part 2- Supermoney

Issue 18| 1971 Part 1- The Dean & The Disciple

Issue 17| 1970 Part 2 - Blue Chip Stamps

Issue 15| The Go-Go Years of the 60s

Issue 14| 1969- Part 2 Illinois National Bank

Issue 13| 1969 - Part 1 Buffett Retires

Issue 12| 1968 - Sun Newspaper & Blacker Printing Company

Issue 11| 1967 Part 2 - National Indemnity

Sabre Arc Portfolio Updates:

December 2024 Review: $1,209,486.84

November 2024 Review: $1,214,498.45

October 2024 Review: $1,132,767

September 2024 Review: $1,137,009

Love the honesty here. Reminds me how conviction gets tested after the buy, not before. The longer I do this, the more I think managing expectations—ours and others’—is the real game. In the end, stewardship often looks more like patience than performance.