A Quick Note

Becoming Berkshire has always been about the journey, not mine, but Buffett and Munger's. But now and then, I'll step out of the timeline and share an update from Sabre Arc, a partnership I help manage.

This isn't the main focus of the newsletter, and it never will be. But it's helpful for me to put my thoughts down, especially when things get noisy. I sometimes feel like Buffett in the 60s, being expected to conform to the money managers of that time, which may alter the type of investor I am. My circle of competence continues to grow as I research companies daily; however, I do have a fundamental understanding of how I operate as an investor and my comfort in allocating capital.

These updates give me space to think out loud, reflect on what I'm seeing, and remind myself what we are trying to build. If nothing else, it helps me stay accountable to the same principles I admire in Buffett & Munger: patience, discipline, and a clear head.

We'll be back to 1973 soon enough. But for now, here's what's going on inside Sabre Arc.

Sabre Arc Capital

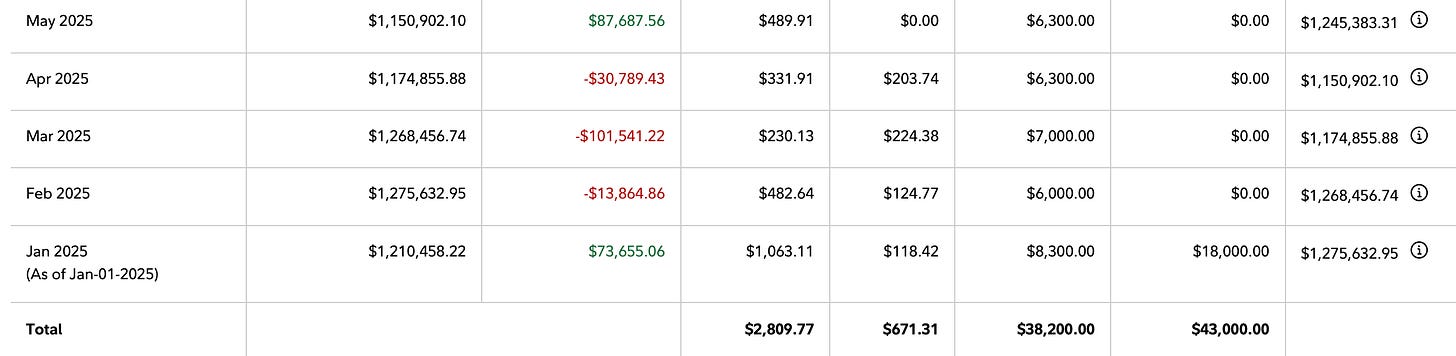

As of the end of May, Sabre Arc ended the month at $1,245,383, an increase of roughly $94,000 from the prior period. Most of that came from market gains, not new capital. We added $6,300 during the month but otherwise stayed quiet.

Year-to-date, the ride has been anything but smooth. We started the year strong in January, gave it all back, and then some by March, and have been slowly digging our way out since. After a sharp drop of over $100,000 in March alone, the partnership has clawed back much of the ground in April and May. All in, we're up just over $35,000 on the year before contributions and a little over $43,000 with them, as we had $18,000 withdrawn in January

It's not a straight line, and it never will be. But we're still standing, still compounding, and still playing the long game.

Core Holdings

Our top three positions, Berkshire Hathaway, Amazon, and Disney, make up just over half the portfolio. That’s intentional, given my invest with conviction mantra.

When we believe in a business, we’re not afraid to let the weight show up in the numbers. We’re not indexing or hugging benchmarks; we’re building a concentrated portfolio of businesses we trust, led by management teams we respect, at valuations we’re willing to sit through some turbulence for.

We’ve held Disney for a while now, and while it hasn’t been an easy ride, we’re glad to see the market finally recognizing some of the value we’ve long believed was there. The company is starting to benefit from the heavy lifting it undertook over the past few years, whether through streamlining content, focusing on parks and experiences, or returning capital to shareholders.

Berkshire and Amazon remain core to our approach; I see them as the foundation of Sabre Arc. Once we surpass $2 million, we will likely start looking at private businesses, yet this entire strategy is built on the solid foundation of Berkshire and Amazon.

Dividends & Interest

Sabre Arc isn’t built for yield. We don’t chase dividends, and most of our capital is tied up in businesses we believe will compound value over time, not necessarily cut checks every quarter.

That said, we’ll never complain when a dividend shows up. We collected just under $500 in May, bringing year-to-date income to a little over $3,200. It’s not the engine driving returns, but it’s a nice reminder that good businesses, especially the mature, cash-generating kind—know how to reward patient ownership.

Looking Back, and Ahead

When Sabre Arc started in 2016, the goal was to build something that mirrored the spirit of Berkshire Hathaway, a partnership rooted in trust, patience, and a long-term mindset. It took years to cross $1 million in assets, and none of it came fast. But over time, through steady contributions and compounding, we’ve grown to over $1.2 million. $2 million is no longer a dream; it’s on the horizon.

That makes it even harder to say that a longtime partner may be leaving.

It hurts. Not because I don’t understand but because I do. Sometimes, you want to be the steward of your own capital; it can’t be easy standing by and letting me make every decision, especially when you might think I am wrong.

I tend to sit at the plate and wait for my pitch far too long. Some partners demand action: if stocks fall 10%, some prefer me to jump in.

I’ve tried to remain consistent, even when the headlines scream otherwise. Macro noise, interest rates, elections, I try not to let any of it dictate how we allocate capital. I don’t always get the timing right, but I do my best to stay anchored in the principles we built this partnership on: patience, conviction, and alignment.

No one said building something lasting would be easy. We’ll keep going, keep learning, and keep doing it the right way, even when it’s hard.

Thanks for being part of it.

Sabre Arc Portfolio Updates:

March 2025 Review: $1,174,370.03

December 2024 Review: $1,209,486.84

November 2024 Review: $1,214,498.45

October 2024 Review: $1,132,767

September 2024 Review: $1,137,009

August 2024 Review: $1,094,182

Becoming Berkshire 1930-1973:

Issue 26| 1973 Part 4- Wesco Financial

Issue 25| 1973 Part 3- The Washington Post

Issue 24| 1973 Part 2 Katharine Graham - Personal History

Issue 23| 1973 Mr. Buffett Goes to Washington

Issue 22| 1972 Part 2 -The Nifty Fifty

Issue 21| 1972 - See's Candies

Issue 20| 1971 Part 3- The Nixon Shock

Issue 19| 1971 Part 2- Supermoney

Issue 18| 1971 Part 1- The Dean & The Disciple

Issue 17| 1970 Part 2 - Blue Chip Stamps

Issue 15| The Go-Go Years of the 60s

Issue 14| 1969- Part 2 Illinois National Bank

Let's continue to play the long game! Onwards

Always nice to hear about how other investors approach their craft. Thank you for this update!